The Facts

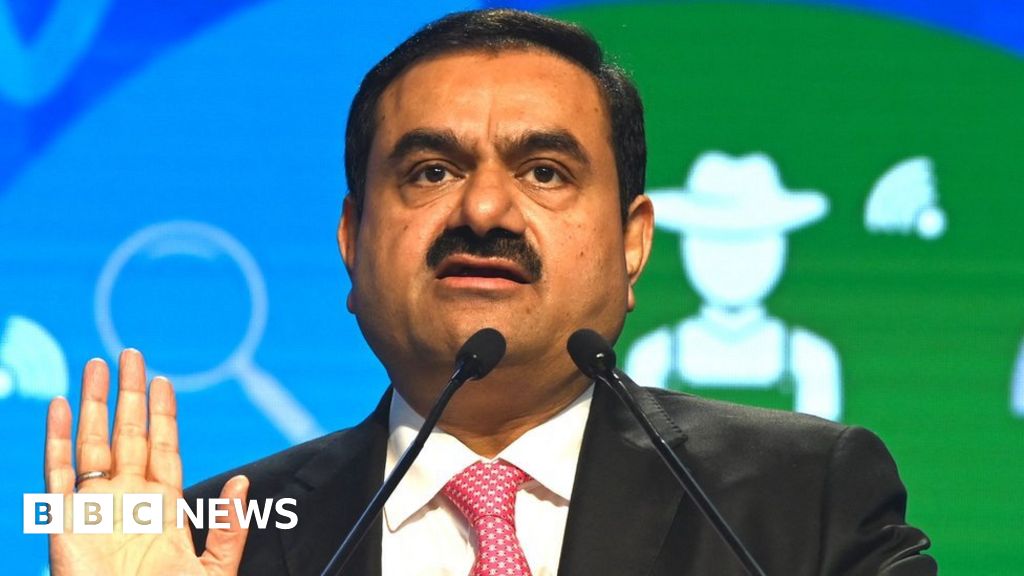

Shares of India's Adani firms — led by Asia's richest man Gautam Adani — sank between 5% and 20% on Monday, wiping out approximately $65B off its market value.

Flagship Adani Enterprises' $2.5B secondary share sale closed at ₹2,892.85 ($35.47), 7% below the ₹3,112 ($38.17) lower end of the offer price band due to weakened sentiment among investors.

The Spin

Narrative A

Hindenburg is a well-respected research outlet in New York's finance circles. Its reports are usually highly credible and extremely well-researched. Allegations of financial irregularities in one of India's largest conglomerates cannot be brushed under the carpet. Hindenburg's research is just the tip of the iceberg; it's a reminder that many Indian companies may be using the same dirty tactics to cement control, boost their valuation, and fuel their expansion with debt.

Narrative B

This is an unwarranted, calculated attack on India and the independence, integrity, and quality of Indian institutions. Hindenburg Research's allegations are nothing short of a calculated securities fraud by a short-seller. Their modus operandi behind the explosive report is working, with Adani firms losing over $65B in market value over three trading days. Public investors lost a great deal by wiping off a large amount of investor wealth, while Hindenburg shamefully made a windfall.